Table Of Content

We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers. If you've file one or multiple claims in the last five years, insurers will likely consider you to be more of a risk for future claims compared to if you had none on your record. Your claims history is one of the biggest factors insurers will consider when determining home insurance premiums.

Best for bundling home & auto insurance: Farmers

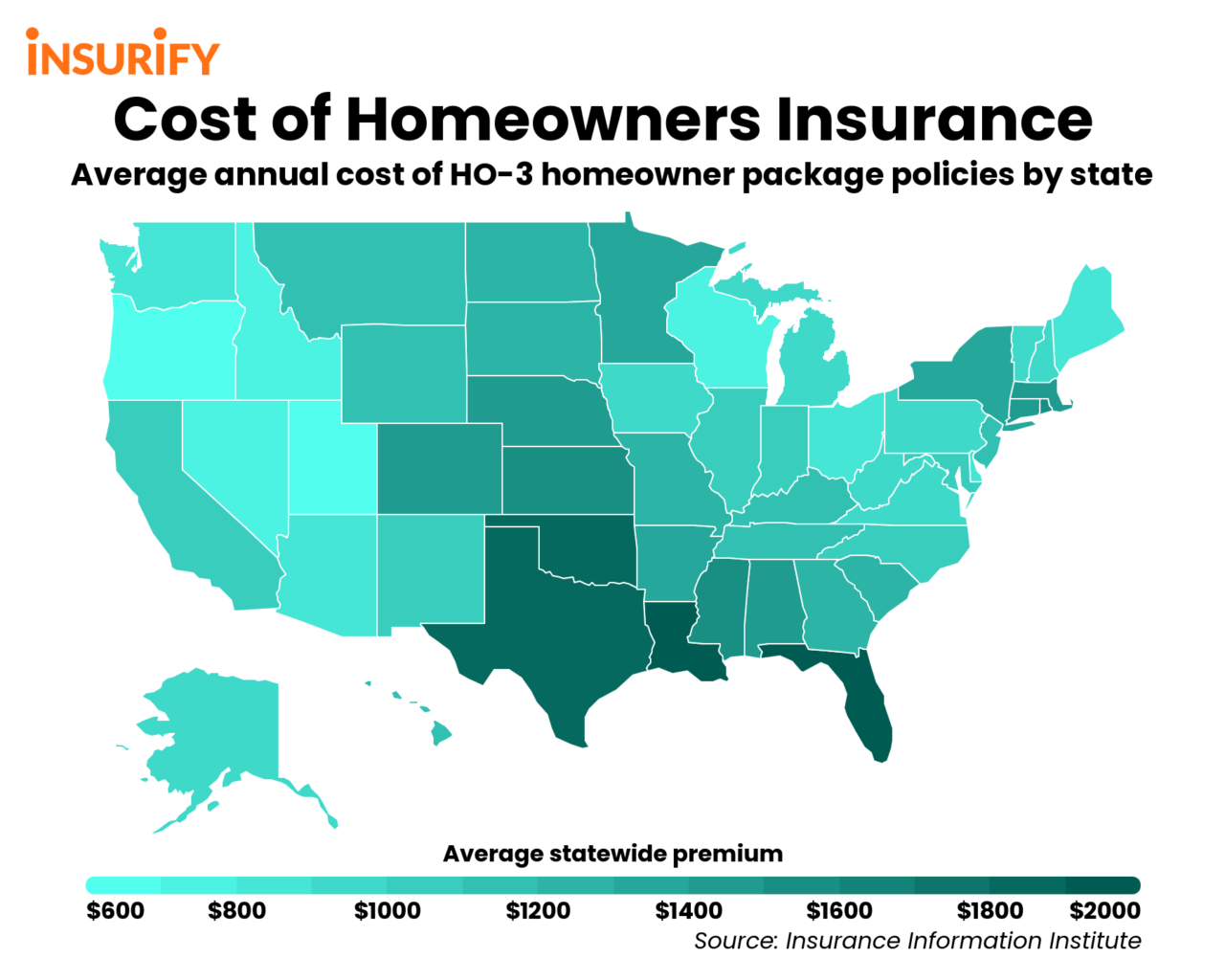

Rates are based on ZIP codes across the nation for varying coverage limits, deductibles and credit. Bundling insurance means you buy both your home and auto insurance policies from the same company. A bundling discount is typically one of the better discounts you can obtain. The cheapest home insurance cost estimate is $746 a year from Progressive, based on Forbes Advisor’s analysis of nationwide costs among large insurers. Replacement cost coverage reimburses you for the cost of buying new, similar items, rather than the depreciated value of what was destroyed. Replacement cost coverage will cost you more but you’ll get a higher payout if you have a personal property claim.

What you need to know about California homeowners insurance

The opinions, analyses, reviews or recommendations expressed in this article are those of the Blueprint editorial staff alone. The information is accurate as of the publish date, but always check the provider’s website for the most current information. However, your local equivalent may offer homeowners insurance in these areas. For example, AAA appears to offer homeowners insurance in Los Angeles County. Insurers in the state took a major hit from catastrophic wildfire losses in 2017 through 2022. Since then, they’ve faced regulatory barriers to charging premiums that reflect heightened risks from climate change, inflation and homebuilding in fire-prone areas.

Are mudslides covered by my home insurance?

Here are the insurers we found with average annual rates equal to or below the California average. We include rates from every locale in the country where coverage is offered and data is available. When comparing rates for different coverage amounts and backgrounds, we change only one variable at a time, so you can easily see how each factor affects pricing. The average cost of homeowners insurance in California is $1,250 per year, or $104 per month.

How much does homeowners insurance cost in California?

As for Rosenberg, she is still looking at all of her options before her current insurance lapses at the end of the month. "And there's two discounts. One has to do with things you can do to your home," Susman said. Such terms and availability may vary by state and exclusions may apply. If you a run a business out of your home your premium may increase to cover the inventory, equipment, and supplies. Repair or replace your covered possessions, regardless of age or condition. Compare rates from participating carriers in your area via EverQuote's website.

— the part of a homeowners policy that covers the house’s structure. Those who buy homes with cash or have paid off their mortgage could legally go without homeowners insurance. However, it’s a risky proposition in a state prone to wildfires and other natural disasters. If you have a mortgage on your home, your lender will likely require hazard insurance — the part of a homeowners policy that covers the house’s structure. In order to find the best cheap home insurance in California, we started by reviewing the most up-to-date rates available. From there, we narrowed the search to include rates from the larger insurers in the state by market share.

Cheapest Homeowners Insurance Providers of April 2024 - MarketWatch

Cheapest Homeowners Insurance Providers of April 2024.

Posted: Wed, 24 Apr 2024 07:00:00 GMT [source]

But if you live in what is called the “wildland urban interface” — a hillside, canyon or other neighborhood close to nature — your options are likely limited and costly, if you can even get a policy. That has forced thousands of homeowners into the California FAIR Plan, an insurer of last resort funded by the industry that offers policies with limited coverage. How much home insurance you need depends on the cost to rebuild your house, how much personal property coverage you need, how much liability insurance you require and other factors. Dwelling insurance pays to rebuild or repair your house if it’s damaged due to a problem covered by your homeowners insurance policy, such as a fire or tornado.

Bamboo is an excellent option for California and Arizona homeowners who’ve struggled to find home insurance elsewhere. It’s one of the few home insurers still writing policies in the Golden State — many have pulled out due to the high risk of wildfires. Using a mix of internal and external rate data, we grade the cost of each insurance company's premiums on a scale from least expensive ($) to most expensive ($$$$$).

Also considered are the materials your house is built with, such as brick, stucco, wood or stone. Unlike auto insurance requirements for vehicle owners, the state of California does not impose minimum insurance requirements on homeowners. It’s up to you to determine what coverage you need, which may include homeowners, earthquake and flood insurance. No, California does not require homeowners to carry homeowners insurance. If you have a mortgage, however, your mortgage servicer will require you to carry enough homeowners insurance to rebuild your home in case of a total loss. Also, if your property is in a high-risk flood zone according to federal flood maps, your lender will require you to carry flood insurance.

His proposals to include so-called “catastrophe modeling” for future fires, storms and big insurance events, as well as the cost of reinsurance in premiums, are controversial among consumer advocates. Here’s what’s going on — and some steps homeowners can take now to lessen the blow. It provides basic hazard coverage when homeowners are unable to get other policies.

The average cost of Travelers homeowners insurance in California is $995 a year, lower than the state average of $1,250. You can use the website to get a homeowners insurance quote, file and track claims, make payments and learn about insurance basics. If you live in an area prone to flooding, a flood insurance policy may help protect against damage to your home and personal belongings. Personal property coverage helps pay to repair or replace furniture, clothes, electronics, tools, and other belongings if they're destroyed in a covered loss. For more expensive items, such as jewelry, art and collectibles, you may need to "schedule" the item, also known as adding an insurance rider to your homeowners insurance policy. Let’s say you have $300,000 dwelling coverage with 50% personal property coverage.

If you experience a break-in, burglary, or property theft, it’s good to know that your home insurance in Los Angeles can help you recover from your loss. You are not required by law to purchase homeowners insurance in Los Angeles. The above is meant as general information and as general policy descriptions to help you understand the different types of coverages. These descriptions do not refer to any specific contract of insurance and they do not modify any definitions, exclusions or any other provision expressly stated in any contracts of insurance.

They’ve responded by passing their costs along to policyholders in the form of higher rates. Additionally, inflation and supply chain issues have raised building costs across the country. That means it would cost more to rebuild your home if it were damaged — another factor leading to higher homeowners insurance prices. California has cheap homeowners insurance rates, averaging just $1,094 per year for $250K in dwelling coverage.

If you want coverage for California earthquake damage, you need to buy a separate earthquake insurance policy. And with flooding becoming more frequent, especially after fires due to burn scars, you may want to consider flood insurance to protect your home. California may be in the middle of a severe drought, but serious storms with flooding still occur. A standard home insurance policy (also known as an HO-3) protects your house for any issues that aren’t specifically excluded in the policy. Common exclusions include earthquakes, flooding, sinkholes, power failure, neglect, wear and tear, and intentional damage. An insurance deductible is the amount subtracted from a claims check if you file a home insurance claim.